Dr. Tan Xiao Publishes a Paper in Manufacturing & Service Operations Management

2025-05-13

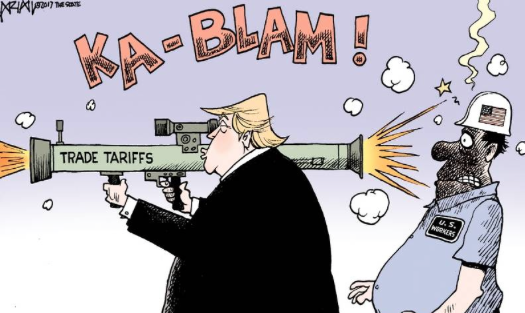

As Sino-US trade policies fluctuate like a roller coaster, with every tariff adjustment tugging at the nerves of businesses—whether to stay overseas or fully retreat—what survival codes are hidden in supply chains under the dual pressures of policy uncertainty and domestic competition?

Dr. Tan Xiao, faculty member of School of Business, East China University of Science and Technology, in collaboration with Prof. Panos Kouvelis from Washington University in St. Louis, USA, and Associate Prof. Sammi Tang from the University of Miami, USA, has recently published a paper titled "Flexibility Value of Reshoring Capacity Under Policy Uncertainty and Domestic Competition" in the top-tier management science journal Manufacturing & Service Operations Management after a five-year academic marathon that tracked the trade war and tariff dynamics from Trump's first term to his second term.

The research background of this paper is that multinational companies have been facing increasing policy uncertainty in recent years, especially the rise of cross-border trade protectionist policies due to geopolitical factors and frequent adjustments of industrial policies. These uncertainties affect the costs of importing raw materials and finished products from low-cost export countries, as well as the relative profitability of production in different countries, promoting the reconstruction of diverse global supply chains. Multinational enterprises invest in reshoring, a strategic operation to build capacity in their home countries, to cope with the risks brought by policy uncertainty and the fierce competition from domestic companies. This investment is not only to avoid tariff risks but also to enhance operational flexibility. However, reshoring decisions are influenced by various factors, including tariff policy uncertainty, the demand-stimulating effect of tax credits, and the efficiency of domestic competitors. The paper uses a game theory model to deeply analyze how these factors affect the reshoring capacity decisions of multinational enterprises and their competitive dynamics with domestic companies, providing reference suggestions for business decision-making at different stages.

Firstly, the paper identifies the differentiated impacts of two types of tariff policies. Finished product tariffs may promote or inhibit reshoring investment, depending on the relative strength of the spillover demand effect and the output quantity effect. In contrast, raw material tariffs always inhibit reshoring investment. Secondly, the paper finds that domestic competition may either inhibit or promote reshoring investment, depending on the cost efficiency of domestic enterprises. Highly efficient domestic companies weaken the reshoring intention of multinational enterprises, while less efficient competitors may encourage multinational enterprises to reshore capacity to capture the domestic market. Thirdly, the paper reveals the positive role of tax credits. By stimulating demand and eliminating the output quantity effect, tax credits significantly enhance reshoring investment and domestic production. Finally, tariff and tax credit policies may have different impacts on firms' expected profits, industry output, and consumer welfare. Tariff policies generally harm the profits of multinational enterprises but affect domestic enterprises differently depending on the intensity of competition. Tax credits may benefit both types of enterprises but may also harm domestic enterprises due to intensified competition. Compared with tariffs, tax credits can more directly stimulate reshoring investment and domestic production while enhancing consumer welfare.

In today's profoundly changing global economic and trade landscape, the supply chain decisions of multinational enterprises are like navigating a boat in turbulent waters. The study shows that although trade protectionist policies may temporarily stimulate some capacity reshoring, the chain reactions they trigger often exceed the expectations of policymakers. Unilaterally imposing tariffs is like a double-edged sword. While changing the location choices of corporate investments, it also significantly increases the living costs of consumers in the importing country and the production costs of manufacturing enterprises. For enterprises caught in the great power game, passively waiting for policy clarity is not the best strategy. The game theory model constructed in this paper reveals that by accurately assessing the dual mechanisms of tariff policies, the efficiency parameters of competitors, and the multiplier effects of fiscal and tax incentives, enterprises can establish a dynamic decision-making framework to take the initiative in the wave of supply chain reconstruction—this may be of more strategic value than simply predicting the rise and fall of tariff rates.

Dr. Tan Xiao is a faculty member of the Department of Management Science and Engineering at the School of Business, East China University of Science and Technology. His main research areas include global supply chains, technology-driven operations management, and game theory.

Panos Kouvelis, Xiao Tan, Sammi Y. Tang. Flexibility Value of Reshoring Capacity Under Policy Uncertainty and Domestic Competition. Manufacturing & Service Operations Management. Forthcoming.

Paper information:

Panos Kouvelis, Xiao Tan, Sammi Y. Tang. Flexibility Value of Reshoring Capacity Under Policy Uncertainty and Domestic Competition. Manufacturing & Service Operations Management. Forthcoming.

Paper link:

https://pubsonline.informs.org/doi/10.1287/msom.2023.0387